Texas Security Deposit Law:

A Complete Guide for Tenants

In Texas, the path to getting your security deposit back begins with one critical action you, the tenant, must take. While landlords have strict obligations, the 30-day countdown for your refund doesn’t even start until you provide a written forwarding address. This guide is built around that central requirement and the other specific rules found in the Texas Property Code.

This page will serve as your roadmap for the Texas-specific procedures, from understanding what constitutes “normal wear and tear” under state law to knowing the heavy penalties a landlord faces for acting in “bad faith.” Mastering these details will empower you to confidently recover the money you’re owed.

Understanding Your Rights Under the Texas Property Code

The rules for security deposits in Texas are outlined in Texas Property Code, Chapter 92, Subchapter C (§ 92.101 and onward). This law is designed to be a clear script for both landlords and tenants to follow when a lease ends. It defines what can be deducted, sets a firm deadline, and, most importantly, establishes a legal presumption of “bad faith” against landlords who don’t follow the rules.

A finding of “bad faith” is not taken lightly in Texas courts and comes with severe financial penalties for the landlord. This guide will break down each component of the law, ensuring you have the knowledge to hold your landlord accountable and leverage the protections the state provides.

This Guide Covers:

The absolute necessity of providing a written forwarding address

The firm 30-day deadline for landlords to issue a refund or an accounting

The Texas legal definition of “normal wear and tear”

The severe penalties landlords face for withholding a deposit in bad faith

How to take action in a Texas Justice Court (Small Claims)

How a Sue.com demand letter can enforce your rights under the Texas Property Code

How Much Can a Landlord Charge for a Security Deposit in Texas?

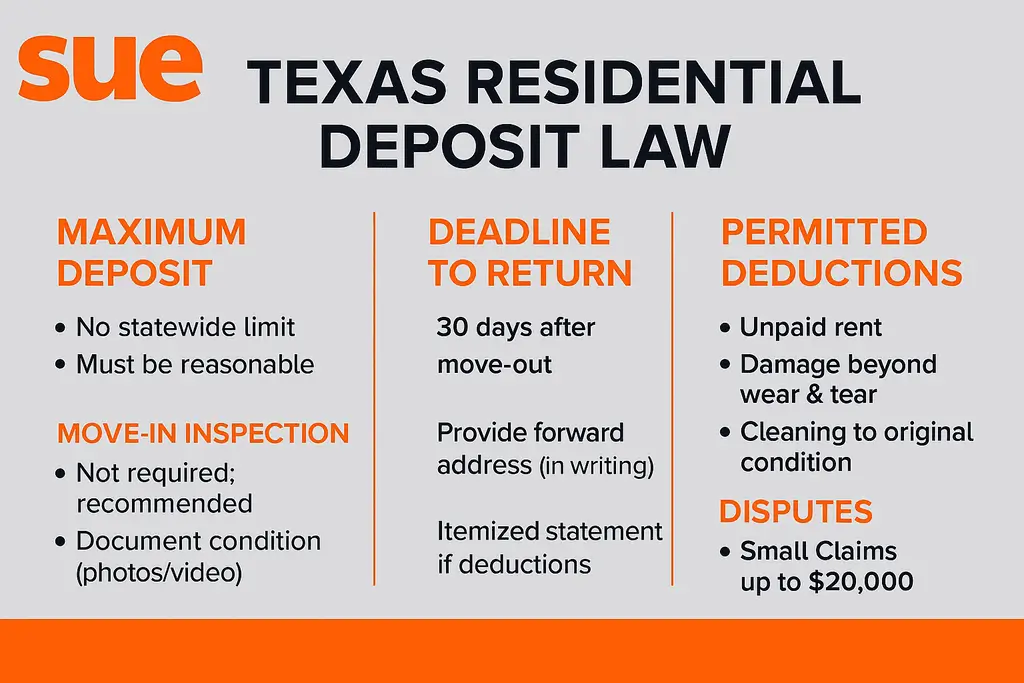

The Texas Property Code does not establish a statewide cap on the amount a landlord can charge for a security deposit. While there is no legal limit, the amount is typically guided by market rates, usually equaling one to two months’ rent. This amount must be specified in your lease. It’s always a good practice to check for any local ordinances in your specific city, as some municipalities may have their own regulations.

What Are Permitted Deductions from a Security Deposit?

A landlord in Texas cannot use your deposit as a personal slush fund for upgrading their property. Deductions are strictly limited to covering costs for which the tenant is legally responsible.

Legal Deductions vs. Normal Wear and Tear

The law allows landlords to deduct for damages you caused that go beyond “normal wear and tear.” The Texas Property Code specifically defines “normal wear and tear” as deterioration resulting from the intended use of a dwelling, but it explicitly excludes deterioration caused by negligence, carelessness, accident, or abuse.

Examples of Normal Wear and Tear (Not Deductible):

Gently worn carpets or floors in main walkways

Faded paint from sunlight

Minor scuffs or small nail holes in walls

Kitchen cabinet finishes that have worn thin from years of use

Examples of Damage (Deductible):

Large holes in the wall or doors

Deep, significant scratches or gouges in a wood floor

Broken appliances or fixtures due to misuse

Pet urine stains that have soaked through the carpet

Other Allowable Deductions

Beyond damages, your landlord can also deduct for any other charges you are liable for under your lease. The most common example is unpaid rent. Some leases may also contain clauses about other specific charges, which must be reviewed carefully.

It is always a good idea to take extensive photos and videos when you move in and move out to document the property’s condition.

The 30-Day Countdown and Your Forwarding Address

This is the most critical section for any Texas tenant. A landlord is required to refund your security deposit or provide a written, itemized list of deductions within 30 days after you surrender the property.

However, this 30-day countdown has a mandatory start condition: the landlord has no duty to act until you provide a written statement of your forwarding address.

The clock starts ticking only after the landlord receives your forwarding address. If you move out on June 1st but don’t provide your address until June 15th, the landlord’s 30-day deadline is now July 15th. For this reason, you should provide your forwarding address on or before the day you move out. The best method is to send it via certified mail, which gives you undeniable proof of the date they received it.

What to Do When a Landlord Breaks the Rules

If you have provided your forwarding address in writing and 30 days have passed without a refund or an itemized list, the law is on your side. A landlord who fails to comply is presumed to have acted in “bad faith.”

Issue a Formal Demand Letter: Your first official action should be to send a demand letter via certified mail. This letter should recap the facts, state the landlord’s violation of the Texas Property Code, and demand the return of your full deposit, reminding them of the penalties for bad faith.

File in Justice Court (Small Claims): If the demand letter is ignored, you can sue the landlord in a Texas Justice Court. If the court finds the landlord acted in bad faith, the penalties are severe. You can be awarded three times the amount of the deposit wrongfully withheld, plus a $100 statutory penalty, plus your reasonable attorney’s fees and court costs.

How Sue.com Enforces Your Texas Tenant Rights

When a Texas landlord acts in bad faith, they are often betting that you don’t know the specific penalties you can pursue. A professional demand letter from Sue.com is a powerful tool that demonstrates you are fully aware of your rights and the landlord’s liability.

For just $39, our Demand Letter Package is your first line of defense:

Professionally Drafted for Texas Law: We craft a letter specifically referencing the Texas Property Code and the severe penalties for bad faith retention.

Legally Authoritative: The letter clearly outlines the consequences of their failure to comply with the 30-day rule.

Sent via Certified Mail: We handle the crucial step of sending the letter via certified mail, providing the legal proof you need.

Cost-Effective: It’s a powerful tool to recover your funds for a fraction of what it costs to hire an attorney.

"Non-Refundable" Deposits Are Illegal in Texas

Under Texas law, a fee is only considered a security deposit if it is refundable. A landlord cannot call a required charge a “non-refundable deposit.” If a fee is designated as non-refundable in the lease, it cannot be a security deposit.

However, a landlord cannot simply keep your security deposit by putting an illegal “non-refundable” clause in your lease. The security deposit must always be refundable if you meet the terms of your lease and leave the property in good condition.

Key Takeaways: Protecting Your Deposit in Texas

The Forwarding Address is Everything: Your #1 priority is to provide your new address to your landlord in writing. Send it via certified mail.

Know the 30-Day Deadline: The landlord has 30 days to act after they receive your forwarding address.

Document the Condition: Take detailed photos and videos of the property on move-in and move-out to dispute damage claims.

Understand “Bad Faith”: A landlord who knowingly and dishonestly withholds your deposit can face penalties of 3x the amount plus $100.

Demand Your Rights: If the landlord violates the rules, a formal demand letter is the proper first response.

Resources

Texas Property Code § 92.101 et seq.: https://statutes.capitol.texas.gov/Docs/PR/htm/PR.92.htm#92.101

Tenants’ Rights Handbook (Texas Attorney General): https://www.texasattorneygeneral.gov/consumer-protection/home-real-estate-and-travel/renters-rights

Texas Justice Court (Small Claims) Information: https://guides.sll.texas.gov/small-claims

Step 1

Answer a Few Simple Questions

Tell us what happened — who owes you, how much, and why. Our system guides you step-by-step with no legal jargon.

Step 2

We Draft Your Texas Demand Letter

Your answers are reviewed and used to create an attorney-drafted demand letter tailored to your case.

Step 3

We Mail It for You

We print and mail the Texas demand letter directly to the recipient via USPS — creating proof you attempted to resolve the matter before court.

Ready to Send Your Texas Demand Letter?

Need Assistance?

Need help?

Find answers

Got questions about how Sue.com works, what’s included in each package, or what happens after your letter is sent? We’ve got you covered — quick, clear answers to help you move forward with confidence.

I told my landlord my new address in person. Is that good enough in Texas?

No. The Texas Property Code requires you to provide your forwarding address in writing. A verbal conversation does not legally start the 30-day countdown and leaves you with no proof.

What evidence helps prove a landlord acted in "bad faith" in Texas?

Evidence can include the landlord failing to respond to your demand letter, providing a completely fabricated list of deductions for damages that didn’t exist (which you can disprove with move-out photos), or simply ignoring the 30-day deadline entirely after receiving your forwarding address.

My lease has a clause that says my deposit is "non-refundable." Is this legal in Texas?

No. A true security deposit in Texas must be refundable. Your landlord cannot keep your deposit simply because of an illegal “non-refundable” clause in the lease if you have otherwise fulfilled your obligations as a tenant.

Can my landlord deduct for painting after I've lived in the unit for several years?

Generally, no. The gradual fading or minor scuffing of paint over several years is considered normal wear and tear. However, if you caused significant damage to the walls, such as large holes or unauthorized paint jobs, they could legally deduct the cost to repair it.

Does the 30-day rule include weekends and holidays in Texas?

Yes. The 30-day deadline is based on calendar days, which includes weekends and holidays. The postmark date on the envelope containing your refund or itemized list must be on or before the 30th day.