Illinois Security Deposit Law

A Complete Guide for Tenants

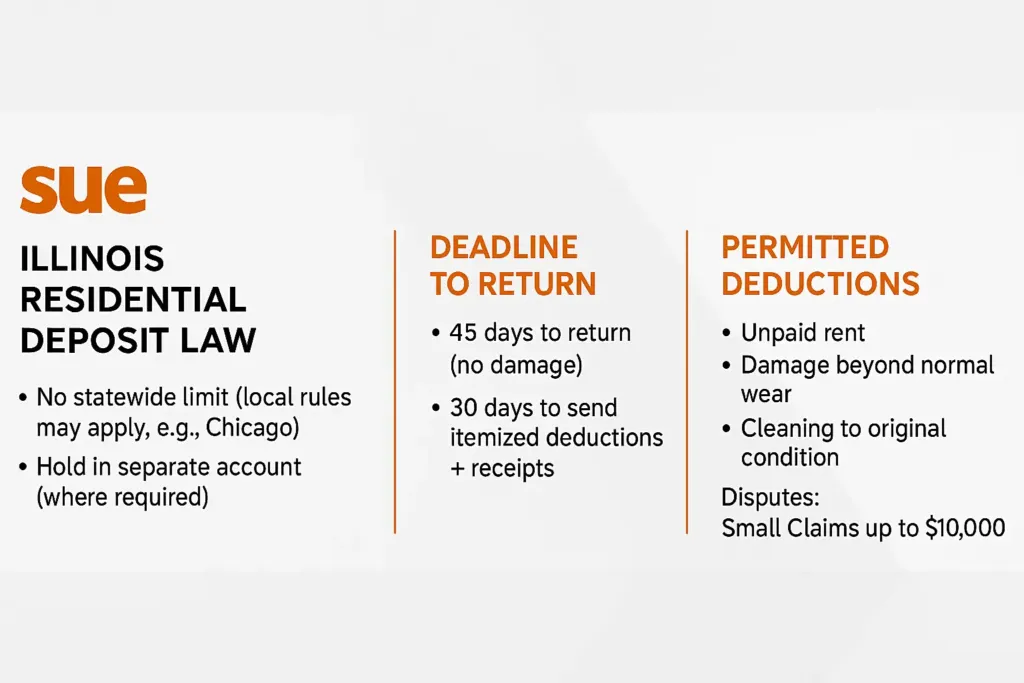

Illinois law provides clear, strict rules for how landlords must handle your security deposit. The process is governed by specific timelines—30 days for deductions and 45 days for a full return—and a failure to follow them can result in serious penalties for your landlord. This guide will explain your rights under Illinois law.

We will cover the deadlines, what counts as a legal deduction, the requirement for landlords to pay interest in many cases, and the steps you can take, including sending a formal demand letter, to recover your money if it’s being wrongfully withheld.

Understanding Your Rights Under the Illinois Security Deposit Return Act

The primary law protecting your money is the Illinois Security Deposit Return Act (765 ILCS 710/1). This state law is not a suggestion; it is a mandatory set of instructions for your landlord. It outlines their exact duties for returning your deposit, providing itemized statements, and paying interest.

The law is specifically designed to prevent landlords from arbitrarily keeping your funds for issues like “normal wear and tear” and gives you a clear path to challenge improper deductions. If a landlord violates this act, the penalties can include paying you double the amount of your deposit.

This Guide Covers:

The unique 30/45-day return deadlines in Illinois

The critical requirement for an itemized list of deductions

What “normal wear and tear” means versus actual damage

The landlord’s duty to pay interest on your deposit (in many cases)

The severe 2x deposit penalty for landlords who violate the act

How a Sue.com demand letter can enforce your rights in Illinois

How Much Can a Landlord Charge for a Security Deposit in Illinois?

Illinois state law does not set a cap on the amount a landlord can charge for a security deposit. While the state doesn’t set a limit, the amount should be reasonable, typically one to two months’ rent.

This is very important: Major cities like Chicago have their own powerful ordinances (the Residential Landlord and Tenant Ordinance, or RLTO) that are often much stricter than state law. This guide focuses on Illinois state law; always check your local ordinances as well.

The 30/45-Day Rule: Returning the Deposit in Illinois

Illinois has a specific, two-part timeline for deposit returns. Which deadline your landlord must follow depends on whether they are making deductions.

Path 1: Full Refund (45-Day Deadline) If your landlord does not intend to make any deductions for damages or unpaid rent, they have 45 days from the date you move out to return the full amount of your deposit.

Path 2: Partial Refund/Deductions (30-Day Deadline) If your landlord plans to keep any part of the deposit for damages, they have 30 days from your move-out date to provide you with a written, itemized statement of deductions. This statement must list the specific damages and the estimated or actual cost of repair.

The Itemized Statement: Your Most Powerful Protection

This is a critical protection for Illinois tenants. If a landlord fails to provide this detailed, itemized statement within the 30-day window, they forfeit their right to deduct any amount from your deposit and must return the full deposit to you immediately.

A simple note saying “for cleaning – $200” is not a valid itemized list. The landlord must list the specific issues (e.g., “broken tile in bathroom,” “hole in bedroom wall”). If they fail to do this, they have violated the law.

The Illinois Interest Requirement

Illinois is one of the few states that requires landlords to pay interest on security deposits, but this rule only applies to landlords with 25 or more units in their building or complex.

If your landlord meets this 25-unit threshold and has held your deposit for 6 months or more, they must pay you the accrued interest on your deposit within 30 days of you moving out.

What to Do When a Landlord Breaks the Rules

If your landlord misses the 30-day or 45-day deadlines, fails to provide a proper itemized list, or makes deductions for normal wear and tear, they have violated the Illinois Security Deposit Return Act.

Send a Formal Demand Letter: Your first step is to send a certified letter. This letter should clearly state the violation (e.g., “You failed to provide an itemized statement within 30 days as required by 765 ILCS 710/1”) and demand the immediate return of your full deposit.

File in Small Claims Court: If the landlord ignores your demand, you can sue them. The penalties for a willful violation are severe. A court can award you double the amount of the security deposit (on top of the original deposit itself), plus your court costs and reasonable attorney’s fees.

How Sue.com Helps You Get Your Deposit Back

Landlords who violate the act are often counting on you not knowing the specific 30/45-day rules or the severe 2x penalty. A professional demand letter from Sue.com is a powerful wake-up call that shows you are serious and informed.

For just $39, our Demand Letter Package is your first line of defense:

Professionally Drafted for Illinois Law: We cite the Illinois Security Deposit Return Act (765 ILCS 710/1) and the specific penalties for non-compliance.

Legally Authoritative: The letter clearly outlines the landlord’s specific violation, whether it’s the missed deadline or the lack of an itemized list.

Sent via Certified Mail: We handle the sending, providing you with the essential proof for your case.

Cost-Effective: It’s the most powerful step you can take to recover your money for a fraction of an attorney’s fee.

Key Takeaways: Protecting Your Deposit in Illinois

30-Day Deadline for Deductions: Landlord must send an itemized list within 30 days if they keep any money.

45-Day Deadline for Full Refund: If no deductions are made, the full deposit must be returned within 45 days.

No Itemized List = Full Refund: If the landlord misses the 30-day itemized list deadline, they must return 100% of your deposit.

Interest is Required: For landlords with 25+ units, they must pay interest on deposits held over 6 months.

Penalty is 2x Deposit: You can sue for double the deposit amount for a willful violation of the act.

Resources

Illinois Security Deposit Return Act (765 ILCS 710/1): https://www.ilga.gov/legislation/ilcs/ilcs3.asp?ActID=2202

Illinois Legal Aid Online (Security Deposits): https://www.illinoislegalaid.org/legal-information/security-deposits

Illinois Attorney General (Landlord/Tenant Rights): https://www.illinoisattorneygeneral.gov/consumers/landlord.html

Step 1

Answer a Few Simple Questions

Tell us what happened — who owes you, how much, and why. Our system guides you step-by-step with no legal jargon.

Step 2

We Draft Your Illinois Demand Letter

Your answers are reviewed and used to create an attorney-drafted demand letter tailored to your case.

Step 3

We Mail It for You

We print and mail the Illinois demand letter directly to the recipient via USPS — creating proof you attempted to resolve the matter before court.

Ready to Send Your Illinois Demand Letter?

Need Assistance?

Need help?

Find answers

Got questions about how Sue.com works, what’s included in each package, or what happens after your letter is sent? We’ve got you covered — quick, clear answers to help you move forward with confidence.

I live in Chicago. Do these rules apply to me?

Yes, but you also have additional protections under the Chicago Residential Landlord and Tenant Ordinance (RLTO), which is even stricter. The RLTO, for example, has different rules for interest and requires the landlord to identify the bank account holding your money.

Can my landlord charge me for carpet cleaning in Illinois?

Only if the carpet is damaged beyond normal wear and tear (e.g., pet stains, burns, large rips). If the carpet is just moderately worn from walking, it’s considered normal wear and tear, and the landlord cannot legally deduct for a routine cleaning.

What if my landlord only provides receipts after the 30 days?

It’s too late for them. The law requires the itemized list of deductions to be sent within 30 days. If they fail to meet that deadline, they have forfeited their right to deduct, even if they have receipts for repairs they made later.

How do I know if my landlord has 25 or more units?

This can be difficult, but you can often tell by the size of the building. If you live in a large apartment complex or know the landlord is a major property management company (e.g., “XYZ Properties”), they almost certainly meet this threshold.

What's the difference between the 30-day and 45-day rule?

It’s simple: If the landlord is keeping any money (even $1), they have 30 days to send you the itemized list. If they are returning all of your money, they have 45 days to send the full refund.