Florida Security Deposit Law:

A Complete Guide for Tenants

In Florida, a security deposit isn’t just a simple damage fund—it’s governed by a set of strict, time-sensitive procedures. From the moment you pay it, your landlord has specific legal duties for how to store it, and when you move out, a formal “claim and objection” process begins. This guide will serve as your roadmap to understanding these critical rules.

Mastering the timelines and notice requirements outlined in Florida law is the key to protecting your funds. This page will demystify the statutes, so you can confidently navigate the process and know when to take action if your money is being wrongfully withheld.

Understanding Your Rights Under Florida Statute § 83.49

The foundation of every tenant’s rights in this area is Florida Statute § 83.49. Think of this not just as a rule, but as a mandatory process. The law dictates where your money can be held, how your landlord can make a claim against it, and the exact steps you must take to dispute any charges.

Unlike in many other states, a landlord in Florida cannot simply decide to keep your deposit and send you a bill. They must follow a formal notification procedure via certified mail. If they fail at any step of this process—from the initial notice of where your money is held to the final claim letter—they may forfeit their right to touch a single cent of your deposit.

This Guide Covers:

The three legal ways a landlord can store your deposit in Florida

The crucial 15-day and 30-day deadlines for returns and claims

How the formal “Notice of Intent to Impose a Claim” works

The vital 15-day window for you to object to a landlord’s claim

What to do if your landlord ignores these strict procedures

How a demand letter from Sue.com can enforce your rights in Florida

How Much Can a Landlord Charge for a Security Deposit in Florida?

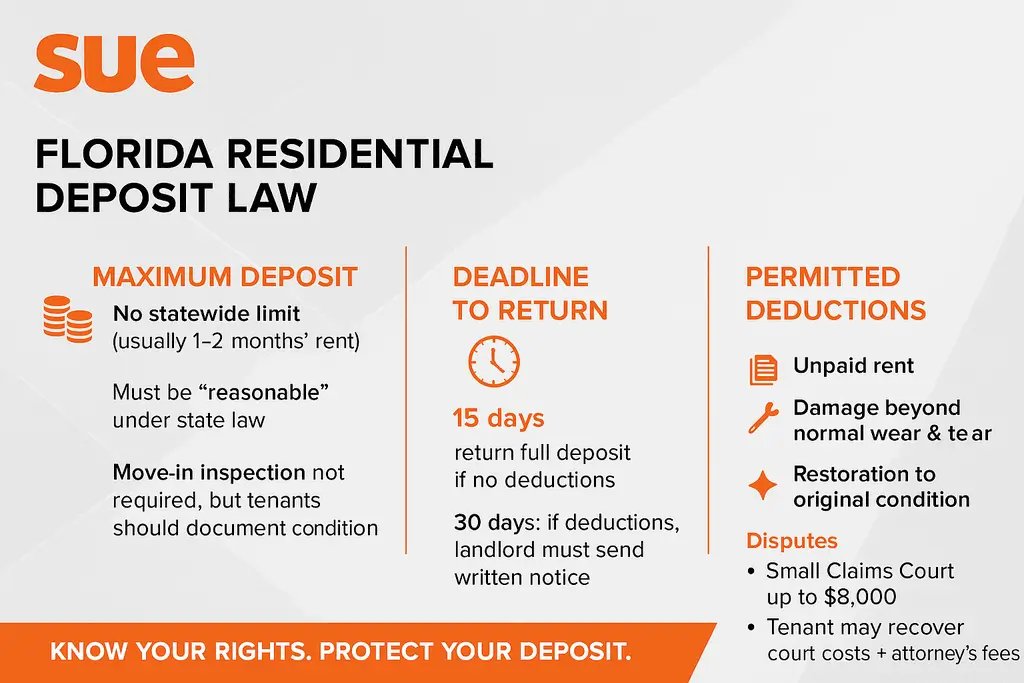

Florida law does not set a statewide cap on security deposit amounts. While there’s no magic number, the market standard is typically one to two months’ rent. This amount should not be excessive and must be clearly defined in your written lease. Always check local city or county ordinances, as some municipalities may impose their own specific limits.

Where is Your Money? Florida's Deposit Holding Requirements

Florida is deeply concerned with the safety of your funds. A security deposit is your money, not the landlord’s. Within 30 days of receiving it, your landlord is legally required to inform you in writing which of these three state-approved methods they are using to hold your deposit:

A Separate Florida Bank Account (Non-Interest-Bearing): Your money is kept entirely separate from the landlord’s personal or business funds.

A Separate Florida Bank Account (Interest-Bearing): Your money is kept separate and accrues interest. The landlord must pay you either 75% of the interest earned or 5% simple interest per year.

A Surety Bond: The landlord posts a bond with the county clerk of courts, essentially an insurance policy guaranteeing the eventual return of your deposit.

This isn’t optional. The landlord must disclose the bank’s name and address or the fact that they’ve posted a bond. Failure to provide this 30-day notice is a violation of the statute.

The Two Paths: Florida's 15 and 30-Day Return Deadlines

When you move out, think of the security deposit return process as splitting into two possible paths, each with a different, strict deadline.

Path 1: No Claims Made (15-Day Deadline)

If your landlord intends to return 100% of your deposit, they have 15 days from your move-out date to get the money to you.

Path 2: Landlord Makes a Claim (30-Day Deadline)

If your landlord believes they have a right to keep any portion of your deposit, they have 30 days from your move-out date to send you a formal “Notice of Intent to Impose a Claim.”

The Formal Claim and Objection Process

This is the heart of Florida’s security deposit law. If a landlord wants to keep your money, a simple text, email, or reduced check is not enough.

They must send you a formal “Notice of Intent to Impose a Claim on Security Deposit”. This letter must be sent by certified mail. Inside, it must contain an itemized list of every deduction and the dollar amount. The notice must also include specific legal language informing you that you have 15 days to object in writing.

Your 15-Day Window to Dispute

Once you receive that certified letter, a new clock starts ticking for you. If you disagree with any of the charges, you have 15 days to formally object in writing. It is crucial to send your objection via certified mail as well, creating a paper trail that proves you met the deadline. If you fail to object, you legally waive your right to dispute the charges.

When a Landlord Breaks the Rules

If your landlord misses the 15 or 30-day deadlines, fails to send the claim notice by certified mail, or makes deductions after you’ve properly objected, they have violated the statute.

Start with a Formal Demand Letter: Your first move should be a professional demand letter sent via certified mail. It should state the specific violation of Florida Statute § 83.49 and demand the return of your full deposit. This official step often resolves the issue without further conflict.

Proceed to Small Claims Court: If the landlord still refuses to comply, your next step is to file a lawsuit. In Florida, if a landlord wrongfully withholds a deposit, a court can award you the deposit amount plus your court costs and attorney’s fees.

How Sue.com Enforces Your Florida Tenant Rights

When dealing with Florida’s formal notice process, a landlord who cuts corners is counting on you not knowing the rules. A professional demand letter from Sue.com shows them you are serious and fully aware of their violations.

For just $39, our Demand Letter Package is your first line of defense:

Professionally Drafted: We craft a letter specifically referencing Florida Statute § 83.49 and your landlord’s exact violation.

Legally Authoritative: The letter clearly outlines the legal consequences of their failure to follow Florida’s strict procedures.

Sent via Certified Mail: We handle the crucial step of sending the letter via certified mail, providing the legal proof you need.

Cost-Effective: It’s a powerful tool to recover your funds for a fraction of the cost of hiring an attorney.

Key Takeaways: Protecting Your Deposit in Florida

Confirm the Holding Method: Ensure you receive a written notice within 30 days of move-in stating where your deposit is held.

Memorize the Deadlines: It’s 15 days for a full refund or 30 days for a formal notice of claim.

Respect the Certified Mail: The notice of claim is only valid if sent via certified mail.

Act Within 15 Days: You must object to a claim in writing within 15 days of receiving it, or you lose your right to dispute.

Demand Your Rights: If the landlord violates any of these steps, a formal demand letter is the proper first response.

Resources

Florida Statute § 83.49 (Landlord and Tenant): http://www.leg.state.fl.us/statutes/index.cfm?App_mode=Display_Statute&URL=0000-0099/0083/Sections/0083.49.html

Florida Consumer Pamphlet (Rights and Duties of Tenants and Landlords):https://www.floridabar.org/public/consumer/tip014/

Florida Courts (Small Claims Information): https://www.flcourts.gov/Resources-Services/Court-Improvement/Family-Courts/Family-Law-Self-Help-Information/Small-Claims

Step 1

Answer a Few Simple Questions

Tell us what happened — who owes you, how much, and why. Our system guides you step-by-step with no legal jargon.

Step 2

We Draft Your Florida Demand Letter

Your answers are reviewed and used to create an attorney-drafted demand letter tailored to your case.

Step 3

We Mail It for You

We print and mail the Florida demand letter directly to the recipient via USPS — creating proof you attempted to resolve the matter before court.

Ready to Send Your Florida Demand Letter?

Need Assistance?

Need help?

Find answers

Got questions about how Sue.com works, what’s included in each package, or what happens after your letter is sent? We’ve got you covered — quick, clear answers to help you move forward with confidence.

What happens if I don't provide a forwarding address in Florida?

While you should always provide one, Florida law does not require you to provide a forwarding address for the landlord’s duties to apply. However, if you don’t, the landlord may send the required notice of claim to your last known address (the rental unit), and you might not receive it in time to object.

My landlord sent me a text message about deductions. Is that a valid notice of claim?

No. Under Florida law, the “Notice of Intent to Impose a Claim on Security Deposit” must be a written notice sent by certified mail within 30 days. An email, text message, or phone call is not sufficient.

I missed the 15-day deadline to object to my landlord's claim. What happens now?

If you do not object in writing within 15 days of receiving the certified mail notice, your landlord is legally authorized to deduct the amount listed in their claim and must return the remaining balance to you within 30 days from the date of the initial notice.

Can my landlord in Florida charge for routine carpet cleaning?

No. A landlord can only deduct for cleaning costs necessary to restore the property to its move-in condition. They cannot charge for routine, standard cleaning between tenants if you did not leave the carpet excessively dirty beyond normal wear and tear.

My landlord never told me where my deposit was being held. Is that a problem for them?

Yes. If a landlord fails to give the required written notice of where the deposit is held within 30 days of receiving it, they may forfeit their right to impose a claim on the security deposit.