Home » California Legal Services & Resources » California Small Claims Court Guide: How to File and Win Your Case

California Small Claims Court Guide:

How to File and Win Your Case

The Small Claims Division of the Superior Court of California provides an accessible judicial forum for resolving civil disputes involving monetary claims up to $12,500 for individual plaintiffs, without the procedural complexity or expense associated with unlimited civil litigation. Established under California Code of Civil Procedure §§ 116.110-116.950, California’s Small Claims Court system is specifically designed to enable parties to represent themselves without attorney assistance—indeed, attorneys are generally prohibited from appearing in small claims proceedings under CCP § 116.530. This comprehensive guide examines every aspect of California Small Claims Court practice, from determining whether your claim qualifies and identifying the proper venue, through filing procedures, evidence presentation, and post-judgment collection. Sue.com provides the professional guidance and documentation necessary to navigate this process successfully and recover the amounts owed to you under California law.

Get Started in Your State

We provide state-specific demand letter services across the country. Find your state below to see our tailored guides and packages for your exact dispute.

John Doe

Content Writer

John Doe

Legal Expert

California Small Claims Court Overview

The Small Claims Division operates as a subdivision of the Superior Court of California, which maintains jurisdiction in each of California’s 58 counties. The following parameters govern small claims practice in California:

Official Court Name: Small Claims Division, Superior Court of California (established under Code of Civil Procedure § 116.110 et seq.)

Maximum Claim Amount: $12,500 for individual plaintiffs; $6,250 for corporations, partnerships, and other business entities. Business entities are further limited to filing no more than two claims exceeding $2,500 in any calendar year under CCP § 116.231.

Who May File: Natural persons, sole proprietors, corporations, partnerships, limited liability companies, and other legal entities may file small claims actions. Assignees of claims (debt collectors) face restrictions under CCP § 116.420.

Who May Be Sued: Individuals, businesses of any form, and—with limitations—government entities may be named as defendants. Claims against California state agencies require compliance with the Government Claims Act (Government Code § 810 et seq.) before filing.

Types of Cases: Small Claims Court jurisdiction extends to claims for money damages only. This includes security deposit recovery, breach of contract, property damage, personal injury, unpaid debts, and consumer disputes. The court cannot issue injunctions, order specific performance, or adjudicate matters requiring equitable relief.

Proper Venue: Under CCP § 116.370, small claims actions must be filed in the judicial district where: (1) the defendant resides or does business; (2) the contract was entered into or to be performed; (3) the injury or property damage occurred; or (4) the buyer resided at the time of a consumer transaction.

Attorney Representation: Attorneys are generally prohibited from representing parties in California Small Claims Court under CCP § 116.530. Parties must represent themselves, though they may consult with attorneys before the hearing. Attorneys may appear on behalf of partnerships, corporations, and other entities.

Appeals: Defendants may appeal an adverse judgment to the Superior Court for a new trial (trial de novo) under CCP § 116.710. Plaintiffs may only appeal denial of their claim, not the amount awarded.

California Laws That Help You Win

California’s statutory framework provides plaintiffs with substantial advantages in small claims litigation. Understanding and citing these laws strengthens your case and establishes clear liability standards.

California Civil Code § 1950.5 (Security Deposit Law)

This statute creates strict obligations for residential landlords and provides automatic penalties for non-compliance. Section 1950.5(g) requires landlords to return security deposits—or provide itemized statements of deductions—within 21 days after the tenant vacates. Deductions exceeding $125 require documentation. Under § 1950.5(l), a landlord who retains a deposit in “bad faith” may be liable for up to twice the deposit amount as a penalty, plus actual damages. In Small Claims Court, plaintiffs who demonstrate a landlord violated the 21-day deadline or provided inadequate itemization typically prevail. The statute creates clear, objective standards that judges apply consistently.

Consumer Legal Remedies Act (CLRA) – Civil Code §§ 1750-1784

The CLRA prohibits 27 enumerated unfair and deceptive practices in consumer transactions. For small claims purposes, the CLRA’s significance lies in its remedial provisions: § 1780 authorizes recovery of actual damages, punitive damages in appropriate cases, and attorney fees and costs. While attorney fees are less relevant in small claims (where attorneys are prohibited), the threat of CLRA liability—and potential appeal to Superior Court where attorney fees become available—creates substantial pressure. Note that CLRA damage claims require 30-day pre-suit notice under § 1782(a); your demand letter satisfies this requirement.

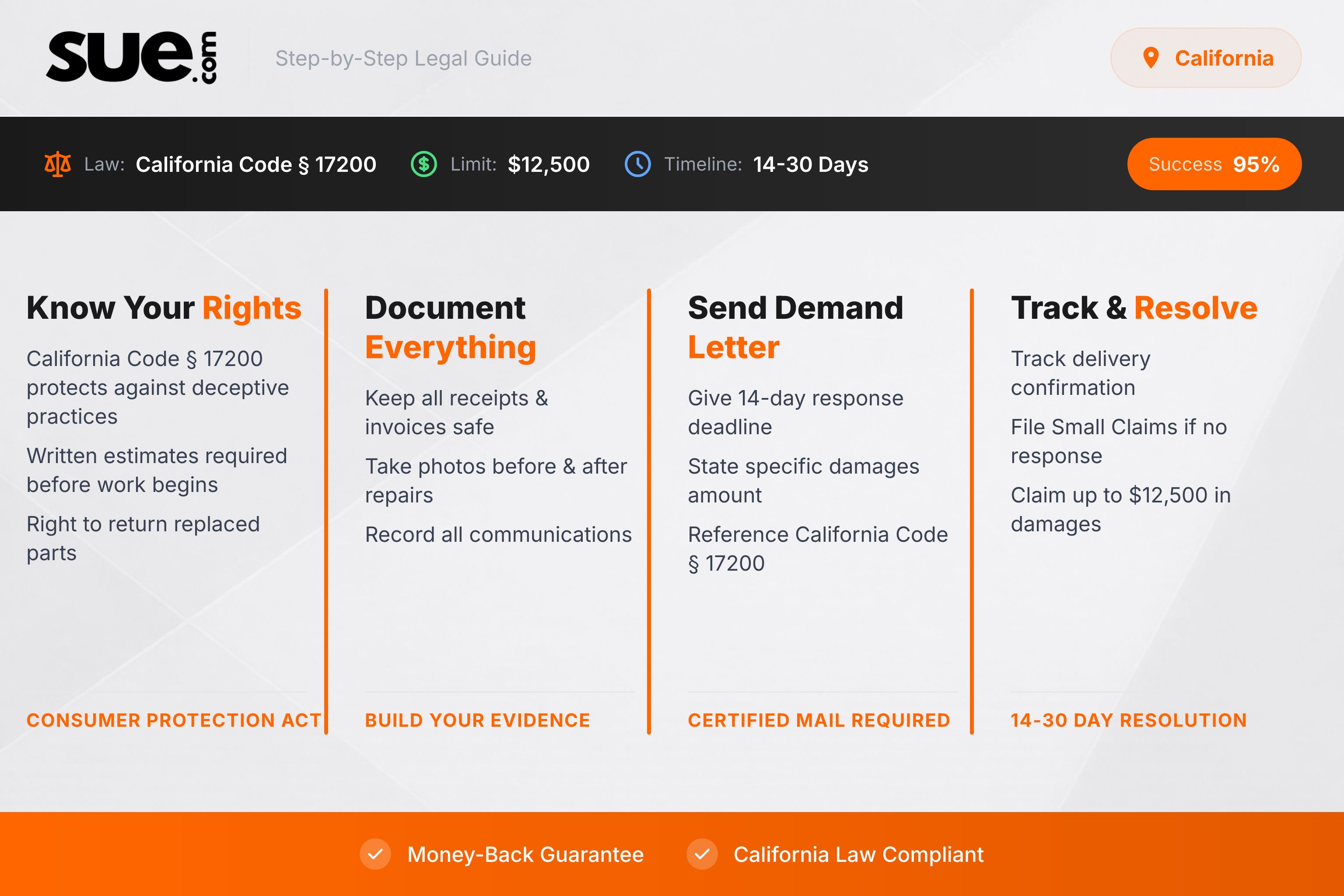

California Business & Professions Code § 17200 (Unfair Competition Law)

Section 17200’s broad prohibition against “unlawful, unfair, or fraudulent business acts or practices” provides a catch-all remedy for consumer harm. While § 17200 claims typically seek restitution rather than damages, Small Claims Court can order restitutionary relief—requiring the defendant to return money wrongfully obtained. This statute’s expansive scope means virtually any business misconduct may support a § 17200 claim, strengthening your position even when other statutes may not precisely apply.

Code of Civil Procedure §§ 116.110-116.950 (Small Claims Act)

These provisions govern all procedural aspects of small claims practice. Key sections include: § 116.220 (jurisdiction and claim limits); § 116.340 (filing requirements); § 116.370 (venue); § 116.530 (attorney prohibition); § 116.610 (hearing procedures); and § 116.820 (enforcement of judgments). Understanding these procedural rules helps you avoid technical errors that could delay or undermine your case.

Common California Small Claims Cases

The Small Claims Division of the Superior Court adjudicates a diverse range of civil disputes. The following categories represent the matters most frequently litigated.

Security Deposit Cases

Security deposit recovery constitutes the most common small claims action in California. If your landlord retained your deposit unlawfully, failed to provide the required 21-day itemization, or made improper deductions, Civil Code § 1950.5 provides clear remedies including potential recovery of up to twice the deposit amount for bad-faith retention.

Auto Repair Disputes

Claims against automotive repair facilities for unauthorized work, overcharges, defective repairs, or failure to return vehicles are governed by the Automotive Repair Act (Business & Professions Code §§ 9880-9889.68). This statute requires written estimates, customer authorization, and return of replaced parts—violations support small claims recovery.

Contractor Disputes

When contractors abandon projects, perform defective work, or demand payment for incomplete services, Small Claims Court provides an efficient remedy. California’s Contractors State License Law (Business & Professions Code § 7000 et seq.) creates additional leverage: unlicensed contractors cannot enforce contracts for compensation under § 7031, and may be required to disgorge all payments received.

Personal Injury Claims

For injuries under $12,500 resulting from negligence—automobile accidents, premises liability, dog bites governed by Civil Code § 3342—Small Claims Court offers faster resolution than unlimited civil court. California’s pure comparative negligence standard allows recovery even when the plaintiff bears partial responsibility.

Property Damage Claims

When another party’s negligence or intentional conduct damages your property, Small Claims Court can award the cost of repair or, if repair is impractical, fair market value. Tree damage claims may invoke Civil Code § 3346, which authorizes treble damages for wrongful injury to timber.

Unpaid Invoice Cases

Freelancers, contractors, and small businesses regularly use Small Claims Court to collect unpaid invoices. California contract law, supplemented by Commercial Code provisions for goods transactions, provides the legal framework. Prejudgment interest may be available under Civil Code § 3287.

Breach of Contract Claims

When parties fail to perform contractual obligations, Small Claims Court awards expectation damages—the amount necessary to place you in the position you would have occupied had the contract been performed. California Civil Code §§ 3300-3302 govern contract damage calculations.

Defective Product Claims

Claims for defective consumer goods invoke the Song-Beverly Consumer Warranty Act (Civil Code §§ 1790-1795.8), which provides for refund or replacement plus civil penalties up to twice actual damages for willful violations. California’s strict products liability doctrine may also apply.

Neighbor Disputes

Boundary disputes, fence cost allocation under Civil Code §§ 841-841.4, tree encroachment, and nuisance claims are regularly adjudicated in Small Claims Court when the monetary amount falls within jurisdictional limits.

Professional Services Disputes

Claims against accountants, consultants, and other professionals for substandard services sound in breach of contract and professional negligence. Small Claims Court can award damages for economic losses caused by professional malpractice.

The California Small Claims Court Process

Successful small claims litigation requires adherence to California’s procedural requirements at each stage of the process.

Step 1: Send a Demand Letter First

Before filing your small claims action, send a formal demand letter to the opposing party. While California law does not require pre-suit demand for most claims, judges expect to see evidence that you attempted resolution before consuming court resources. For Consumer Legal Remedies Act claims, the 30-day notice requirement under Civil Code § 1782(a) is mandatory—failure to provide notice bars recovery of damages. Your demand letter becomes evidence of the defendant’s refusal to resolve the matter voluntarily.

Step 2: File Your Claim

File a Plaintiff’s Claim and ORDER to Go to Small Claims Court (Form SC-100) with the Small Claims Division of the Superior Court in the proper venue. Identify the correct courthouse using the venue rules in CCP § 116.370. Filing fees in California range from $30 (claims up to $1,500) to $75 (claims over $5,000). If you cannot afford fees, file a Request to Waive Court Fees (Form FW-001).

Step 3: Serve the Defendant

After filing, you must serve the defendant with the claim and hearing notice at least 15 days before the hearing (25 days if the defendant is outside the county). California law permits service by: (1) sheriff or marshal; (2) registered process server; (3) any adult non-party; or (4) certified mail with return receipt (if defendant signs the receipt). Service fees typically range from $40-$75 for sheriff service. Proof of service (Form SC-104) must be filed with the court before the hearing.

Step 4: Prepare Your Evidence

Compile all documentation supporting your claim:

- Contracts, leases, invoices, and receipts

- Photographs and video evidence

- Text messages, emails, and written correspondence

- Your demand letter with proof of mailing

- Repair estimates and expert opinions

- Witness information (witnesses may testify in person or provide declarations)

- Wage garnishment under CCP § 706.010 et seq. (subject to exemptions)

- Bank levy under CCP § 700.140

- Property lien by recording an Abstract of Judgment with the county recorder

- Asset seizure through a Writ of Execution under CCP § 699.510

Organize materials chronologically and prepare three copies: one for you, one for the judge, and one for the defendant.

Step 5: Attend Your Hearing

On your hearing date, arrive early at the designated courtroom, dress professionally, and bring all evidence and copies. When your case is called, you will present your claim to the judge or commissioner. State the facts clearly and chronologically, present your evidence, cite the applicable California statutes, and specify the exact amount you seek. The defendant will respond, and you may have an opportunity for rebuttal. Judges typically announce decisions immediately or mail written rulings within a few days.

Step 6: Collect Your Judgment

If you obtain a favorable judgment, the defendant has 30 days to pay or appeal. If the defendant fails to pay voluntarily, California provides multiple enforcement mechanisms:

How Sue.com's California Small Claims Court Package Works

Sue.com’s $249 California Small Claims Court package provides comprehensive professional guidance for every stage of your case.

Attorney-written demand letter included — California judges expect evidence that you attempted resolution before filing. Our demand letter, drafted by licensed attorneys, cites the specific California Civil Code, Business & Professions Code, and other statutory provisions applicable to your dispute, creating essential documentation for your case file.

Step-by-step filing guide customized for California Small Claims Court procedures, walking you through Form SC-100, fee payment, and filing requirements specific to your county’s Superior Court.

Court identification — We determine exactly which Superior Court location has proper venue for your case based on the defendant’s residence, business location, or where the dispute arose, ensuring you file in the correct judicial district.

Required forms list with direct links to official California Judicial Council forms, including SC-100 (Plaintiff’s Claim), SC-104 (Proof of Service), and any supplemental forms required for your claim type.

Evidence checklist specific to your dispute category, ensuring you compile the documentation California judges require to rule in your favor—contracts, photographs, correspondence, and statutory violation evidence.

Damage calculation breakdown showing exactly what you can claim under California law, including actual damages, statutory penalties (such as double damages under Civil Code § 1950.5(l)), and prejudgment interest where applicable.

Court day preparation guide — What to wear, how to address the judge, how to present evidence effectively, common procedural mistakes to avoid, and what to expect during your hearing.

Everything you need to confidently represent yourself and win in California Small Claims Court.

Step 1

Answer a Few Simple Questions

Tell us what happened — who owes you, how much, and why. Our system guides you step-by-step with no legal jargon.

Step 2

We Draft Your Florida Demand Letter

Your answers are reviewed and used to create an attorney-drafted demand letter tailored to your case.

Step 3

We Mail It for You

We print and mail the Florida demand letter directly to the recipient via USPS — creating proof you attempted to resolve the matter before court.

Ready to Send Your Florida Demand Letter?

Need Assistance?

Need help?

Find answers

Got questions about how Sue.com works, what’s included in each package, or what happens after your letter is sent? We’ve got you covered — quick, clear answers to help you move forward with confidence.

What is the small claims court limit in California?

The maximum claim amount in California Small Claims Court is $12,500 for natural persons (individuals). Corporations, partnerships, limited liability companies, and other business entities are limited to $6,250 per claim and may file no more than two claims exceeding $2,500 in any calendar year under Code of Civil Procedure § 116.231. These limits apply to the principal claim amount; court costs and, in certain statutory claims, attorney fees may be awarded in addition to the jurisdictional maximum.

How much does it cost to file in California Small Claims Court?

Filing fees in California Small Claims Court are determined by claim amount: $30 for claims up to $1,500; $50 for claims between $1,500 and $5,000; and $75 for claims exceeding $5,000. Service of process fees add $40-$75 for sheriff service or $25-$50 for registered process servers. If you prevail, the court may order the defendant to reimburse your filing and service costs. Fee waivers are available for individuals who cannot afford fees by filing Form FW-001.

Do I need a lawyer for California Small Claims Court?

No—in fact, attorneys are generally prohibited from representing parties in California Small Claims Court under Code of Civil Procedure § 116.530. The system is designed for self-representation. Parties may consult with attorneys before the hearing, but must appear and present their own cases. Corporations and other entities may be represented by employees, officers, or directors. Sue.com’s $249 package provides professional guidance equivalent to attorney consultation at a fraction of the cost.

How long does a California small claims case take?

From filing to hearing, most California small claims cases are resolved within 30-70 days, depending on court calendar availability in your county. After filing, you must serve the defendant at least 15 days before the hearing (25 days if outside the county). The judge typically announces the decision at the hearing or mails a written ruling within a few days. Defendants have 30 days to pay or file an appeal.

What if the defendant doesn't show up to court?

If the defendant was properly served but fails to appear at the hearing, you may request a default judgment under Code of Civil Procedure § 116.610. You must still present evidence establishing your claim and damages—the judge does not automatically award your requested amount simply because the defendant is absent. If the court grants default judgment, you may immediately begin collection efforts. Defendants may file a motion to vacate default judgment within 30 days if they demonstrate good cause for their absence.

What if I win but they refuse to pay?

California provides robust judgment enforcement mechanisms. You may garnish wages under CCP § 706.010 et seq. (subject to statutory exemptions protecting a portion of earnings). You may levy bank accounts under CCP § 700.140 by obtaining a Writ of Execution from the court. You may record an Abstract of Judgment with the county recorder to create a lien on the defendant’s real property. You may also request the court to order the defendant to appear for a judgment debtor examination to identify assets. California judgments remain enforceable for 10 years and may be renewed for additional 10-year periods under CCP § 683.110.