Home » California Legal Services & Resources » Demand Letters

How to Write and Send a Demand Letter

In California

A California demand letter constitutes the foundational legal document in virtually any civil dispute, serving as formal notice to the opposing party that you intend to pursue your claim through the California court system if necessary. Under California law, a properly drafted demand letter creates an official record of your grievance, establishes the legal basis for your claims by citing applicable California Civil Code and Business & Professions Code provisions, and demonstrates to Superior Court judges that you exhausted reasonable efforts to resolve the matter before initiating litigation. The substantial majority of civil disputes in California—including security deposit claims, consumer fraud matters, and breach of contract actions—resolve at the demand letter stage, as defendants recognize the significant statutory penalties they face under California’s robust consumer protection framework. This comprehensive guide examines the California statutes that strengthen your demand letter, the procedural requirements for effective service, and the manner in which Sue.com’s professional demand letter service can maximize your likelihood of a favorable resolution.

Get Started in Your State

We provide state-specific demand letter services across the country. Find your state below to see our tailored guides and packages for your exact dispute.

John Doe

Content Writer

John Doe

Legal Expert

Why Send a Demand Letter in California?

The transmission of a formal demand letter in California serves multiple critical legal and strategic functions that substantially increase your probability of recovering the amounts owed to you without the necessity of court intervention.

First, a demand letter creates an official legal record of your claim under California law. This documentation establishes the date you placed the opposing party on notice, the specific amounts demanded, and the legal basis for your position—all of which become admissible evidence should the matter proceed to the Small Claims Division of the Superior Court of California.

Second, your demand letter formally notifies the defendant of your intention to pursue legal action if they fail to respond satisfactorily. California courts have consistently held that parties who receive proper notice and fail to act bear greater responsibility for the resulting litigation costs and delays.

Third, Superior Court judges throughout California’s 58 counties expect litigants to demonstrate that they attempted to resolve disputes prior to consuming judicial resources. A well-documented demand letter satisfies this expectation and positions you favorably before the court.

Fourth, by citing specific California statutes—including Civil Code § 1950.5 for security deposits, the Consumer Legal Remedies Act for consumer fraud, or Business & Professions Code § 17200 for unfair business practices—your demand letter communicates to the opposing party the precise penalties they face for non-compliance, including statutory damages, treble damages, and attorney fee liability.

Fifth, establishing a clear response deadline creates urgency and compels action. California practice typically allows 15-30 days for response, depending on the nature of the claim.

Finally, empirical evidence demonstrates that the majority of civil disputes resolve following receipt of a professionally drafted demand letter, thereby saving both parties the substantial time and expense associated with California Small Claims Court proceedings.

California Laws That Give Your Demand Letter Teeth

California maintains one of the most comprehensive consumer protection frameworks in the United States. The following statutes provide substantial leverage when cited in your demand letter, as they create clear liability standards and significant penalty provisions.

California Civil Code § 1950.5 (Security Deposit Law)

This statute governs all residential security deposit matters in California and imposes strict obligations on landlords. Under § 1950.5(g), landlords must return the security deposit—or provide an itemized statement of deductions with remaining balance—within 21 days of the tenant vacating the premises. The itemization must include documentation for any deductions exceeding $125. Landlords who retain deposits in “bad faith” may be liable for up to twice the amount of the security deposit under § 1950.5(l), in addition to actual damages. Citing this statute in your demand letter establishes the landlord’s clear legal obligation and the specific penalties for non-compliance, creating substantial pressure for voluntary resolution.

Consumer Legal Remedies Act (CLRA) – Civil Code §§ 1750-1784

The CLRA prohibits 27 specific unfair or deceptive practices in consumer transactions, including misrepresenting the characteristics of goods or services, advertising goods without intent to sell them as advertised, and making false statements regarding price reductions. Critically, § 1782 requires that before filing a CLRA lawsuit seeking damages, you must provide the defendant with written notice of the alleged violations and demand correction. This 30-day notice requirement makes your demand letter not merely advisable but legally mandatory for CLRA claims. Successful CLRA plaintiffs may recover actual damages, punitive damages, attorney fees, and costs under § 1780.

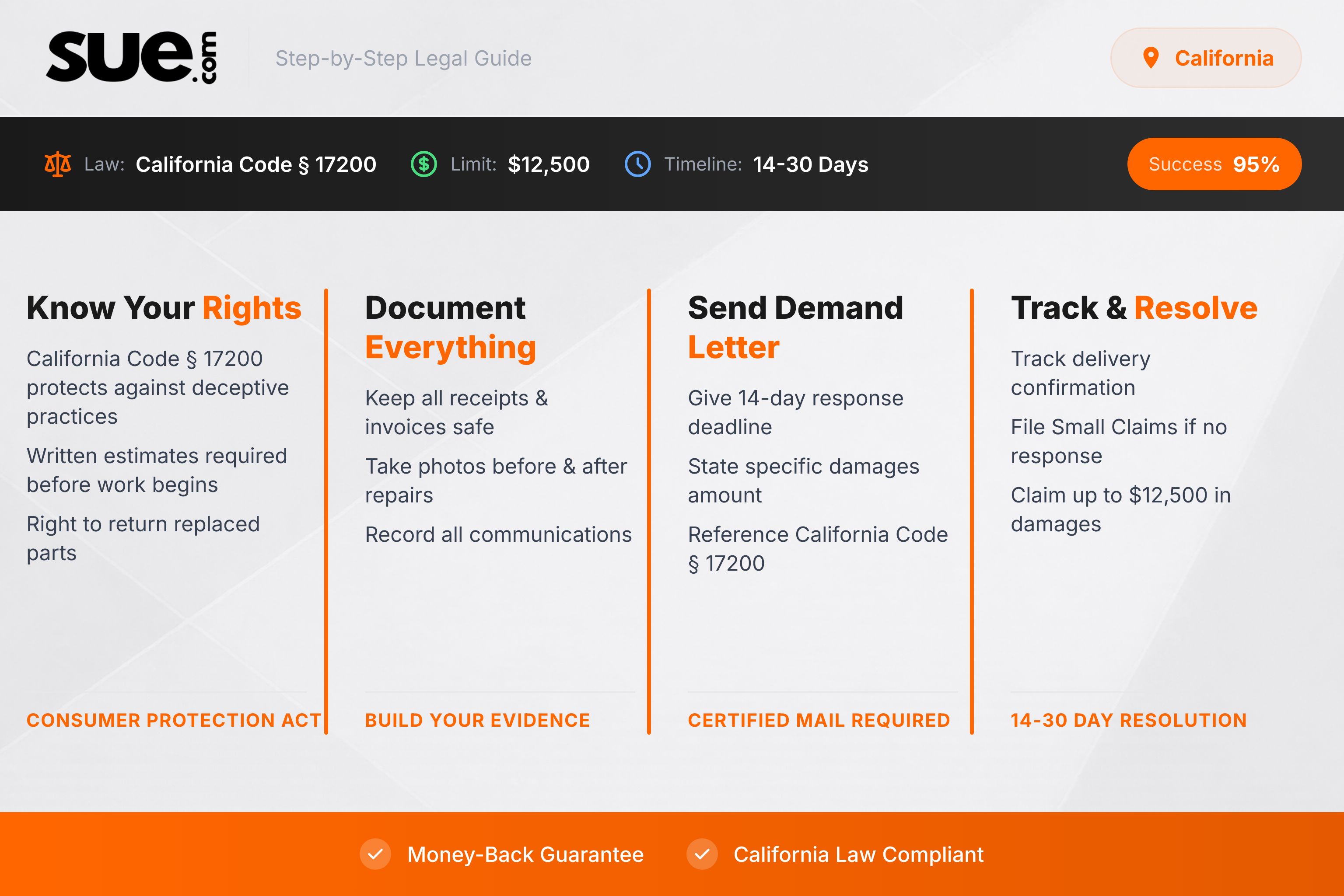

California Business & Professions Code § 17200 (Unfair Competition Law)

Section 17200 broadly prohibits any “unlawful, unfair, or fraudulent business act or practice.” This statute’s expansive scope encompasses virtually any violation of another law (unlawful), any practice that harms consumers regardless of technical legality (unfair), and any practice likely to deceive members of the public (fraudulent). While § 17200 claims typically seek restitution rather than damages, the threat of UCL litigation—with its potential for injunctive relief and restitutionary disgorgement—creates significant pressure on businesses to resolve disputes. Citing § 17200 in your demand letter signals that you understand California’s broad consumer protection framework.

Song-Beverly Consumer Warranty Act – Civil Code §§ 1790-1795.8

California’s “Lemon Law” extends far beyond automobile purchases to cover all consumer goods sold with express or implied warranties. Under § 1794, if a manufacturer or retailer fails to repair defective goods after a reasonable number of attempts, consumers may recover the purchase price plus a civil penalty of up to two times the actual damages if the failure to comply was willful. For defective product claims, citing Song-Beverly in your demand letter establishes the defendant’s warranty obligations and the substantial penalties available for continued non-compliance.

Common California Disputes That Require a Demand Letter

California law provides remedies for a comprehensive range of civil disputes. The following categories represent the most common matters where a formal demand letter serves as the essential first step toward resolution.

Security Deposit Disputes

When a California landlord fails to return your security deposit within the 21-day statutory period mandated by Civil Code § 1950.5, or provides an inadequate itemization of deductions, a demand letter citing the specific statutory provisions and bad-faith penalty of up to twice the deposit amount typically compels prompt resolution.

Auto Repair Disputes

California’s Automotive Repair Act (Business & Professions Code §§ 9880-9889.68) requires written estimates, authorization before performing work, and return of replaced parts upon request. If a California mechanic performed unauthorized repairs, charged for work not performed, or refused to release your vehicle, a demand letter citing these provisions and the Bureau of Automotive Repair’s enforcement authority creates immediate pressure.

Contractor Disputes

When a licensed or unlicensed contractor abandons a project, performs defective work, or demands payment for incomplete services, a demand letter citing California’s Contractors State License Law (Business & Professions Code § 7000 et seq.) establishes your claim. Notably, unlicensed contractors cannot enforce contracts for payment under Business & Professions Code § 7031, providing significant leverage in disputes.

Personal Injury Claims

For injuries resulting from another party’s negligence, a demand letter documents your damages, establishes the defendant’s liability, and places their insurance carrier on formal notice. California’s pure comparative negligence standard (Li v. Yellow Cab Co., 13 Cal.3d 804) allows recovery even if you bear partial fault, making demand letters valuable in a wide range of injury matters.

Property Damage Claims

When another party’s negligence or intentional conduct damages your property, a demand letter establishes liability and quantifies your losses under California’s measure of damages for property torts—typically the cost of repair or fair market value if repair is impractical.

Unpaid Invoice Disputes

For goods or services provided but not compensated, a demand letter citing California Commercial Code provisions and contract law establishes your right to payment and may include claims for prejudgment interest under Civil Code § 3287.

Breach of Contract Claims

When another party fails to perform contractual obligations, a demand letter citing the specific contract provisions and California Civil Code §§ 3300-3302 (contract damages) establishes the breach and your resulting damages.

Defective Product Claims

For products that failed or caused damage, a demand letter citing the Song-Beverly Consumer Warranty Act and California’s strict products liability standards establishes manufacturer and seller responsibility.

Neighbor Disputes

Property line encroachments, fence disputes governed by Civil Code §§ 841-841.4, tree damage claims under Civil Code § 3346 (allowing treble damages for wrongful timber removal), and nuisance claims can often be resolved through formal demand letters citing these specific provisions.

Professional Services Disputes

When accountants, consultants, or other professionals provide substandard services, a demand letter establishes claims for breach of contract and professional negligence under California standards of care.

The California Demand Letter Process

Effective demand letter practice in California requires adherence to established procedural standards that maximize your leverage and create admissible evidence for potential litigation.

Step 1: Document Your Claim

Prior to drafting any correspondence, assemble comprehensive documentation supporting your position. This includes contracts, invoices, receipts, photographs, text messages, emails, and any records of payment or damage. California Evidence Code governs admissibility, and your demand letter should reference specific documentary evidence by date and description.

Step 2: Research the Applicable California Law

Identify the California statutes applicable to your dispute. Security deposit claims invoke Civil Code § 1950.5. Consumer fraud claims may implicate the CLRA (Civil Code § 1750 et seq.) or Business & Professions Code § 17200. Contract disputes are governed by California Civil Code provisions and applicable Commercial Code sections. Accurate statutory citation demonstrates legal sophistication and creates pressure.

Step 3: Calculate What You’re Owed

Determine the precise amount of your claim, including:

- Actual damages (deposit amount, repair costs, contract value, medical expenses)

- Statutory penalties where California law provides them (e.g., double damages under § 1950.5(l))

- Prejudgment interest if applicable under Civil Code § 3287

- Incidental and consequential damages directly caused by the defendant’s conduct

Your demand letter must include: your complete contact information; a clear, chronological statement of facts; identification of the specific California statutes violated; the exact dollar amount demanded with itemization; and a firm deadline for response. For most California disputes, 15-30 days constitutes a reasonable response period. For CLRA claims, the statute mandates a 30-day correction period under Civil Code § 1782(a).

Step 5: Send Via Certified Mail

California courts recognize certified mail with return receipt requested as valid proof of delivery. This creates an evidentiary record establishing that the defendant received your demand. Retain the certified mail receipt and delivery confirmation for your court file.

Step 6: Wait and Document

Allow the full response period to expire before taking further action. Document any communications received. If the defendant satisfies your demand, obtain written confirmation. If they fail to respond or refuse payment, you have established the evidentiary foundation necessary to file in California Small Claims Court.

How Sue.com's California Demand Letter Service Works

Sue.com’s $199 California demand letter service provides professional legal documentation designed to maximize your probability of resolving your dispute without court intervention.

Your demand letter is attorney-written by licensed legal professionals who customize the content for your specific California dispute, citing the exact Civil Code, Business & Professions Code, and other statutory provisions applicable to your matter.

The professional formatting signals to the opposing party that you possess legal representation and are prepared to pursue your claim through the California court system if necessary.

We mail your demand letter for you via certified mail with return receipt requested, creating proof of delivery that California Superior Court judges recognize as valid service of the demand.

Your letter includes response deadline and escalation language that creates urgency and clearly communicates the consequences of non-compliance, including the statutory penalties available under California law.

The California-specific statute citations ensure the opposing party understands precisely what damages, penalties, and attorney fee liability they face if the matter proceeds to litigation.

The substantial majority of disputes resolve at this stage, saving you the time and expense of California Small Claims Court proceedings. Should the opposing party fail to respond satisfactorily, your demand letter—with certified mail tracking—becomes essential evidence when you escalate to California Small Claims Court.

Step 1

Answer a Few Simple Questions

Tell us what happened — who owes you, how much, and why. Our system guides you step-by-step with no legal jargon.

Step 2

We Draft Your Florida Demand Letter

Your answers are reviewed and used to create an attorney-drafted demand letter tailored to your case.

Step 3

We Mail It for You

We print and mail the Florida demand letter directly to the recipient via USPS — creating proof you attempted to resolve the matter before court.

Ready to Send Your Florida Demand Letter?

Need Assistance?

Need help?

Find answers

Got questions about how Sue.com works, what’s included in each package, or what happens after your letter is sent? We’ve got you covered — quick, clear answers to help you move forward with confidence.

Is a demand letter required before suing in California?

For most civil claims in California, a demand letter is not a statutory prerequisite to filing suit—however, it is strongly advisable and expected by Superior Court judges. There are notable exceptions: Consumer Legal Remedies Act claims require a 30-day written notice under Civil Code § 1782(a) before seeking damages. Failure to provide this notice can result in dismissal of CLRA damage claims. Additionally, certain construction defect claims require pre-litigation notice under Civil Code § 910.

What California laws should I cite in my demand letter?

The applicable statutes depend on your dispute category. Security deposit claims should cite Civil Code § 1950.5. Consumer fraud matters may invoke the CLRA (Civil Code §§ 1750-1784) and/or Business & Professions Code § 17200. Warranty claims should reference the Song-Beverly Consumer Warranty Act (Civil Code §§ 1790-1795.8). Contract disputes cite relevant Civil Code and Commercial Code provisions. Accurate citation demonstrates legal knowledge and creates pressure.

How long should I give them to respond to my California demand letter?

Standard practice in California allows 15-30 days for response, depending on the complexity of the matter. For CLRA claims, the statute mandates a 30-day correction period before you may file suit seeking damages. Your deadline should be specific (e.g., “within 21 calendar days of the date of this letter”) and should clearly state that legal action will follow if the deadline passes without satisfactory resolution.

What if they ignore my California demand letter?

If the opposing party fails to respond or refuses to satisfy your demand, you may file a claim in the Small Claims Division of the Superior Court of California for amounts up to $12,500 (individuals) or $6,250 (businesses). Your demand letter—with certified mail tracking proving delivery—becomes evidence demonstrating that you attempted resolution and the defendant refused. California judges view this favorably when evaluating your credibility and the defendant’s conduct.

Can I write my own demand letter or do I need a lawyer?

You possess the legal right to draft your own demand letter. However, a professionally written letter citing correct California statutes, formatted appropriately, and delivered via certified mail is substantially more effective at compelling response. The opposing party is more likely to take professionally drafted correspondence seriously. Sue.com’s attorney-written demand letters cost $199 and include certified mailing service.

How do I prove I sent a demand letter in California?

Certified mail with return receipt requested through the United States Postal Service creates an evidentiary record that California courts accept as proof of delivery. The tracking number, delivery confirmation, and signed receipt (if obtained) establish that the defendant received your demand on a specific date. Sue.com handles this process automatically—we mail your letter via certified mail and provide complete tracking documentation.